Christmas Savings Account

We all know that Christmas can be one of the most costly times of the year, with presents to buy for friends and family, plus those big-budget supermarket shops for all that festive food and drink.

But don’t worry, with our popular Christmas savings account, you can manage some of the inevitable expense by making deposits throughout the year. This can be done by standing order or, if you work for one of our Payroll Partners, from your salary.

To encourage you to keep your savings until Christmas, accounts are locked until the season arrives, with withdrawals only permitted between October 1 and January 31 each year.

With our handy mobile app, you’ll be able to keep track of your savings and request a withdrawal 24 hours a day. Or just give us a call during our opening hours.

Once you’ve set up your NLCU account, just contact us by email or phone to open a separate Christmas Savings account. There’s even the possibility you could receive a dividend on your savings in November.

If Christmas is fast approaching, and you think your savings account alone won’t cover the cost, we have a special Christmas loan, with competitive rates and easy repayments.

Savings

How do I pay into my account?

You can make deposits into your savings account with us either by cheque, by bank transfer or by payroll deduction. If you have lost your NLCU bank account details then just get in touch and we’ll confirm them for you.

The amount you save we leave up to you! There are no transactional fees with saving. We have a range of savings accounts and you can request your deposits be split for different purposes like Christmas or Holidays. The maximum balance we can hold in our accounts for a single person is £10000.

Do I get a return on my savings?

Usually yes! As a financial cooperative we share our profits with our shareholders – and all our customers are our shareholders.

Once we have paid for running costs and paid into our legally required reserves we share the rest amongst members based on the amount in their savings. The dividend that we pay to our members is voted on at our yearly AGM – see our downloads page for more info from our last AGM.

How do I withdraw money from my account?

You can withdraw funds:

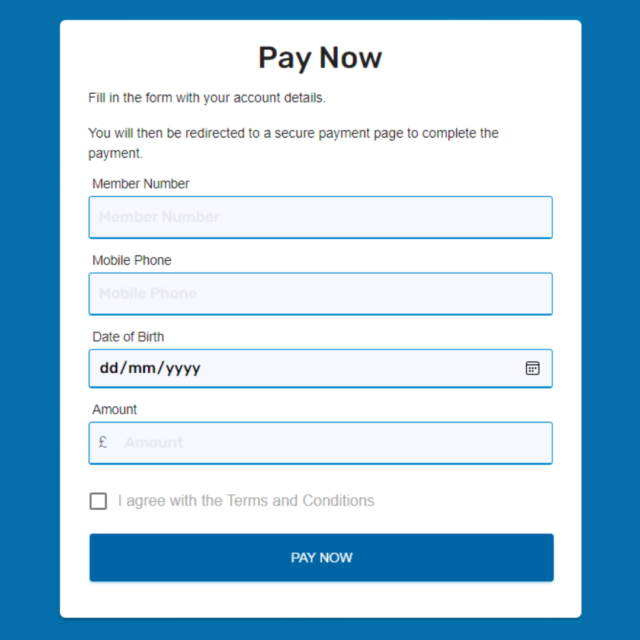

- Online using our online banking service or our mobile app

- Over the phone on 0330 004 0842 – lines open Monday to Friday 10am-3pm

How soon will my requested withdrawal reach my bank account?

Requested withdrawals are processed between 9am and 3pm every weekday. Withdrawals made after 3pm, on weekends or bank holidays will be sent the following workday morning.

If requested online, this show as “Pending” until we’ve set up your withdrawal.

Are my savings safe?

Notts and Lincs Credit Union is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

All savings held with Notts and Lincs Credit Union are protected under the Financial Services Compensation Scheme which protects savings up to the value of £85,000.