The Current Account for Everyone

Open a Clockwise Credit Union Current Account to make managing your money easier.

Stay on top of your spending & take charge of your budget

- 💷 Pay in Salary or Benefits

- 🏧 Cash at ATM, Branch or Post Office

- Standing Orders & Direct Debits

- 🏦 Savings Wallets

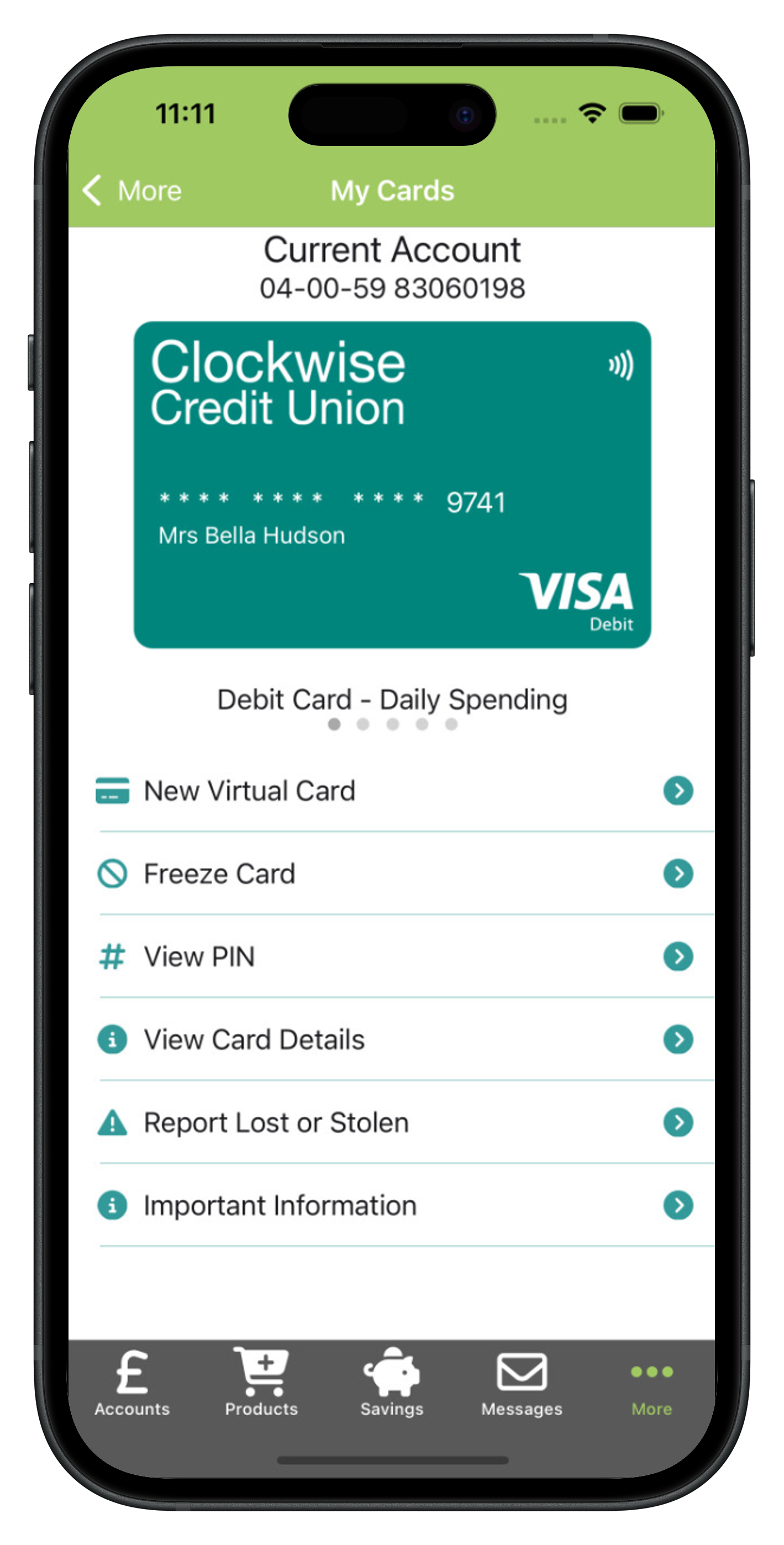

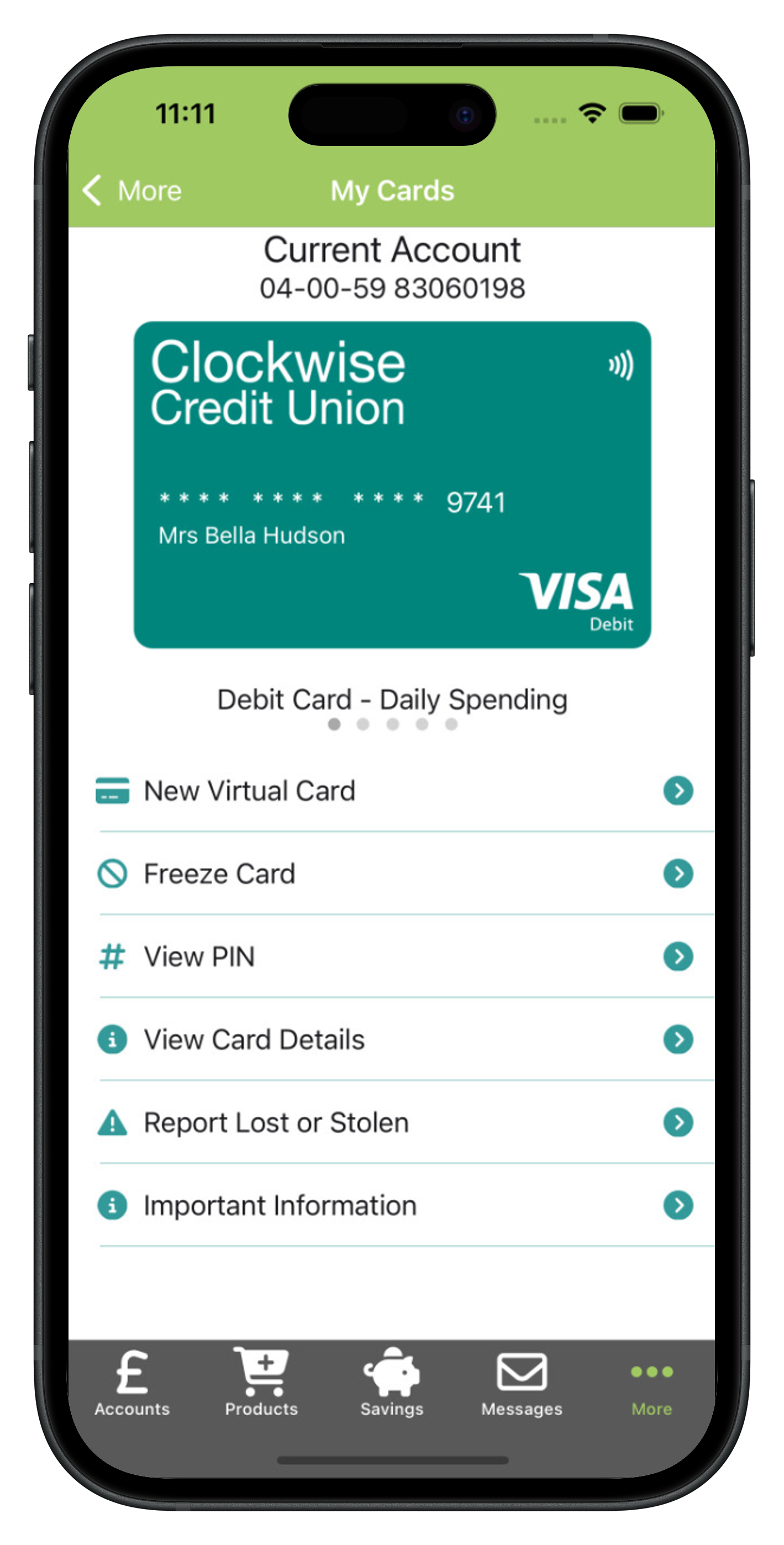

- 💳 Add Virtual Card

- ⏫ Round Up Savings

- 👐Keep your money in the local community

The Clockwise Credit Union’s regulated products/services are provided in partnership with PayrNet Limited. PayrNet Limited is authorised by the Financial Conduct Authority (FCA) as an Electronic Money Institution, with FRN 900594. Company registered in England & Wales with registration no. 09883437 and registered office at 3rd Floor, Vintners’ Place, 68 Upper Thames Street, London EC4V 3B. PayrNet Limited is a wholly owned subsidiary of Embedded Finance Ltd and operates under the trading name “Railsr”. Cards are issued by PayrNet under licence from Mastercard International Incorporated and Visa Europe. Your funds are safeguarded in accordance with the Electronic Money Regulations 2011 and are not protected by the Financial Services Compensation Scheme (FSCS).

Get rewarded for switching to a Current Account that actually gives back

Every time you use your card, you’re automatically entered into a monthly draw to win £100. The more you use your card, the more likely you are to win!

- 💷 Pay in Salary or Benefits

- 🏧 Cash at ATM, Branch or Post Office

- Standing Orders & Direct Debits

- 🏦 Savings Wallets

- 💳 Add Virtual Card

- ⏫ Round Up Savings

- 👐Keep your money in the local community

The Clockwise Credit Union’s regulated products/services are provided in partnership with PayrNet Limited. PayrNet Limited is authorised by the Financial Conduct Authority (FCA) as an Electronic Money Institution, with FRN 900594. Company registered in England & Wales with registration no. 09883437 and registered office at 3rd Floor, Vintners’ Place, 68 Upper Thames Street, London EC4V 3B. PayrNet Limited is a wholly owned subsidiary of Embedded Finance Ltd and operates under the trading name “Railsr”. Cards are issued by PayrNet under licence from Mastercard International Incorporated and Visa Europe. Your funds are safeguarded in accordance with the Electronic Money Regulations 2011 and are not protected by the Financial Services Compensation Scheme (FSCS).

- 1️⃣ Open your Current Account with Debit Card

- 2️⃣ Use your card for everyday spending (each purchase counts as an entry)

- 3️⃣ Each month, one transaction is picked and you win £100

Our current account is open to everyone – No matter what life looks like, we’re here for you.

Save money, pay bills, set up regular payments, and get your salary or benefits paid straight in.

Simple to use, easy to manage — everything you need to stay on top of your money.

- Control Spending

- Use as a Backup / Second Account

- Open to those new to the UK

- All credit histories considered

- No impact on your credit score

Free Transfers

Send and receive money between accounts instantly*

Contactless VISA Debit Card

Cash withdrawals, shop online or in-store

Free Standing Orders & Direct Debits

Pay bills automatically at no extra charge

Savings Wallets

Organize your finances and set aside money for specific goals

Optional Overdraft

£100 interest free overdraft (subject to eligibility - Everyday plan only)

No Hidden Charges

No charges for payments in, payments out, Direct Debit or Standing Orders

Round-Up Savings

Automatically save a little from every purchase

Virtual Cards

More control over your spending and increased online safety - at no extra cost

Manage your card with our App

Get updates via the mobile app each time you spend.

Your Local Credit Union

Clockwise membership also unlocks great savings options and affordable loans

*Faster Payments are subject to automated fraud checks, and may occasionally be subject to a delay of up to 1 working day

Debit Card Plans & Pricing

You could save with Clockwise compared to other pre-paid cards.

FREE to receive or send money. FREE to use Direct Debits or Standing Orders.

PAY AS YOU GO

Best for occasional use e.g. one or two cash withdrawals per month-

£5 Debit Card Delivery

-

Collect Cash at Post Office - £1.00

-

ATM withdrawal - £1.50

-

Card purchases in the UK - 30p

-

Balance enquiry at ATM - FREE

-

No Overdraft

VALUE

Great value for day-to-day purchases with only occasional cash withdrawals-

Free Debit Card Delivery

-

Collect Cash at Post Office - £0.75p

-

ATM withdrawal - £1

-

Card purchases in the UK - FREE

-

Balance enquiry at ATM - FREE

-

No Overdraft

EVERYDAY

All features and best value for day-to-day use as your main account.-

Free Debit Card Delivery

-

Collect Cash at Post Office - FREE

-

ATM withdrawal - FREE

-

Card purchases in the UK - FREE

-

Balance enquiry at ATM - FREE

-

£100 Overdraft

Clockwise Current Account Fees & Charges

| Feature | Pay as you go | Value | Everyday |

|---|---|---|---|

| Monthly Fee | NONE | £4.50 | £8.50 |

| Card Delivery | £5.00 | FREE | FREE |

| Virtual Card | FREE | FREE | FREE |

| Collect Cash from Post Office | £1.00 | £0.75 | FREE |

| Cash at Branch | FREE | FREE | FREE |

| Faster Payment (Deposit/Withdraw) | FREE | FREE | FREE |

| Direct Debits & Standing Orders | FREE | FREE | FREE |

| CHAPS Payment | £15.00 | £15.00 | £15.00 |

| Free Buffer | Not Available | Not Available | £100 Interest Free |

| Arranged Overdraft (APR) | – | – | 42.6% |

| ATM Withdrawal (UK) | £1.50 | £1.00 | FREE |

| Card Purchases (UK) | 30p | FREE | FREE |

| ATM Balance Enquiry | FREE | FREE | FREE |

| Lost/Damaged Card | 1st replacement free, then £5 | ||

| ATM Withdrawal (Europe) | £1.00 + 1% | ||

| ATM Withdrawal (Worldwide) | £1.50 + 1.5% | ||

| Card Purchase (Europe) | £0.50 + 1% | ||

| Card Purchase (Worldwide) | £0.50 + 1.5% | ||

| Chargeback Administration | £20.00 | ||

| ATM Withdrawal Limit | £250 per withdrawal / £1,000 per day | ||

| Card Spend Limit | 15 transactions per day | ||

| Pay at Pump | Not Available | ||

| Max Account Balance | £10,000 | ||

| Faster Payment Limits | 5 credits and 5 withdrawals per day | ||

Virtual Cards -

Shop Smarter and Stay Safe

Manage your subscriptions easily

Like Netflix or Spotify? Sometimes free trials aren’t so “free” — they keep charging you! With a virtual card, you can close it after signing up, making sure no more surprise payments happen.

Keep Your Spending Under Control with Virtual Cards

Make a special virtual card for each thing you spend on.

It’s like giving your money its own little safe!

Want to let your child buy apps or games? Give them a virtual card just for that.

You can block or unblock it anytime to stay in charge of the spending.

Stay safe when shopping online

Buying something from a new website or a shop overseas? Use a virtual card! You can close it right after you pay, so no one can take more money from you.

Overdraft - £100 interest free overdraft

Only available on the Everyday plan

Need a bit of breathing room? With the Everyday plan, you can get up to £100 interest-free overdraft — no stress, no sneaky charges.

Just be an Everyday member for 2 months and pay in at least £500 a month from your salary or benefits. Simple as that.

Because life doesn’t always wait for payday.

Terms and conditions apply.

Roundup Savings

Save little and often while you spend

Every time you buy something using your Clockwise current account debit card, we will round up your spending to the nearest pound and add the spare change in to your Round Up wallet. For example, if you buy a coffee for £1.79 we will round it up to £2 and 21p will be added to your savings.

You’ll have easy access to the wallet so you can keep your Round Up balance growing or withdraw at your convenience.

FAQ

The Clockwise current account is available to new and existing members who meet our membership criteria. Applicants must be over 18 years of age and UK residents.

When you apply, we will ask you to provide proof of your home address and identity. We accept a range of forms of ID including, in some circumstances, referral letters from recognised local charities and support organisations. You can find out more here.

No, the Clockwise current account is available to all regardless of credit score.

Providing current accounts involves a range of costs—from administration to card issuer and ATM fees. While some banks promote ‘free’ accounts, the reality is that these often come with hidden charges that add up over time.

We believe in a more transparent approach—offering accounts that genuinely reflect the cost of service, with a straightforward, low monthly fee.