Back to School

We understand that Back to School supplies can end up costing a lot every year, and at a time when families are already facing pressure from the increasing cost of living it’s important to know where to turn for help.

According to the Children’s Society, the average cost of getting children back to school is £315 per Primary School pupil and £337 per Secondary School pupil. Many parents struggle to cover these essential costs – how can you avoid breaking the bank or overspending in the lead-up to September?

How can your local credit union help with covering the costs of Back to School?

Here at Notts and Lincs Credit Union we offer a range of accounts, loans, and guidance to suit your individual needs. Using this we will aim to help you into a position to manage your Back to School spending, and ease the financial pressure this brings about.

Take a look at the loan calculator below to get an idea of what your loan will look like.

Calculate your monthly cost

Representative example*

Please be aware that this is not a loan offer and the figures quoted in this document are based on the Representative APR which may differ from the actual APR you qualify for after we have conducted a credit search. As a result, this should only be used as an indicative illustration.

The calculator is for illustration purposes only. Rates may be withdrawn at any time. We reserve the right to refuse any application.

Here are some tips to get the most out of your Back to School spending:

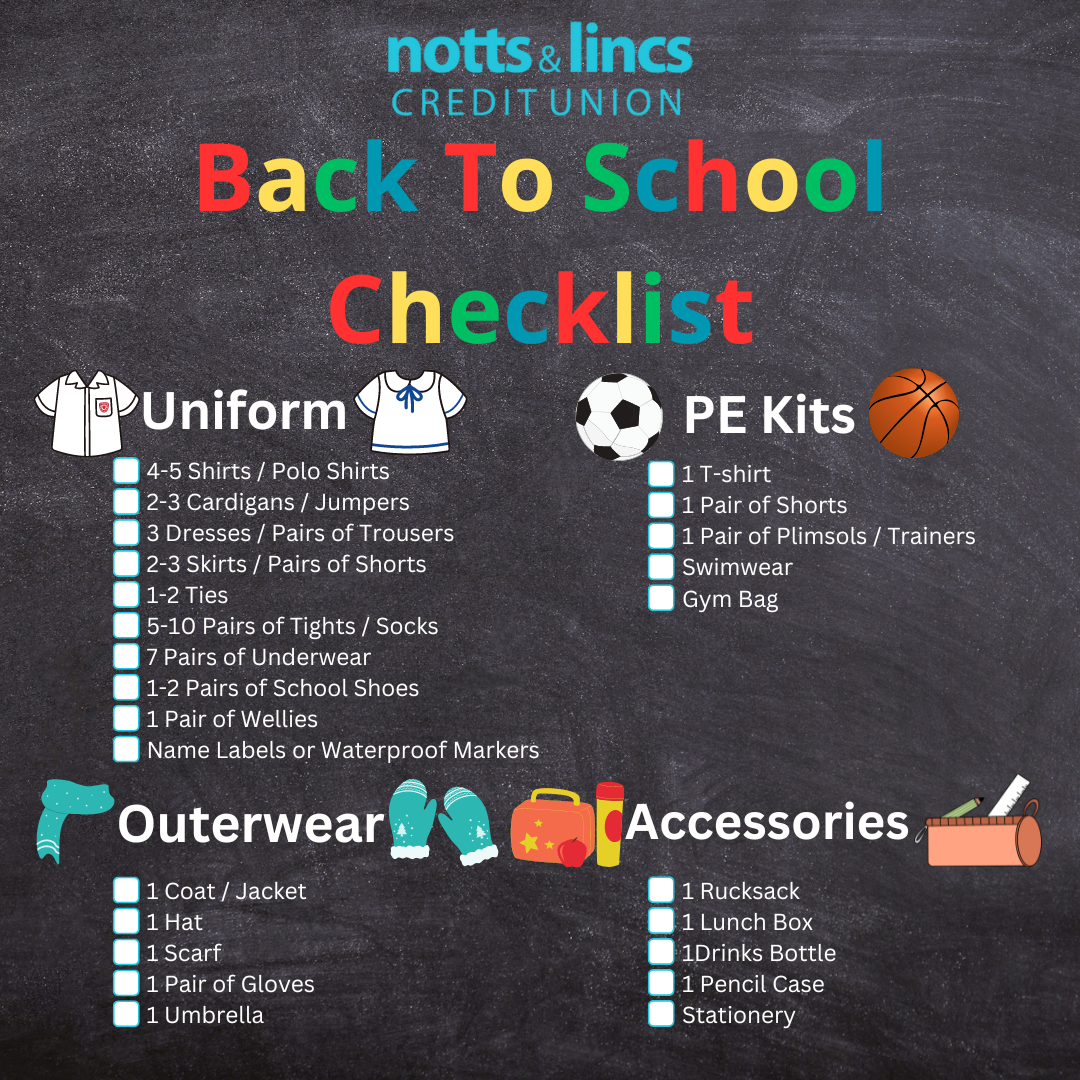

- Make a list of what you need - Check out our list below! See what you have already, what you need to buy, and what the school requires you to provide.

- Get the best deal – Keep an eye out for bargains and deals on school uniforms in supermarkets and on sites like MoneySavingExpert. Don’t forget to check back for clearances and sales regularly to get the best prices to get ahead for the next school year.

- Spread the cost – If you can, try to spread the cost out to avoid overspending. Replace damaged or outgrown clothes during the school year – or buy a size up to grow into.

- It doesn’t have to be brand new – You can often get second-hand clothes as hand-me-downs, or from other parents. You may also find old stationery and supplies hanging around your house that you can pass along. Don’t be afraid to check charity shops, car boot sales and things like Facebook Marketplace, especially for the more costly purchases.

- Budget – Know where your finances stand and what you can afford to spend by analysing your budget. Try this Budget Planner from Money Helper to get started!

- Save – Along with your budget, make sure to plan ahead for next year by saving what you can. Saving just £6.50 per week per child can ensure you have enough to meet the average cost of getting your child ready for school again.

Notts and Lincs Credit Union offers a number of simple savings accounts to help take care of your spending worries. Don’t forget you can also save for the next big spend, birthdays, holiday, or Christmas – and our Goal Savings account can help you keep track!

How much do i need to save?

If you save just £6.50 per week per child (or £28.10 per month), you’ll easily have enough saved up in a year’s time to get everything you need, based on the average cost – totalling £338.00 from saving weekly (£337.20 from a monthly saving).

Life is full of unexpected costs, especially when you have children, and in the face of the cost of living crisis it’s more important than ever to make sure you are covered for as much as you can be. Saving for school supplies is a great way to get into the habit, and saving just a little more can make sure you’re ready for anything like medical/dentist fees, childcare, or any other unexpected spending.

Open a Savings Account with NLCU and get started today!

Can borrowing help?

If you’re running out of time and need help to prepare for this year’s Back to School spend, don’t enter into any high-cost loans or credit cards, and don’t be tempted to borrow from a Loan Shark to make ends meet. You can look to NLCU to help with a low-cost loan to help you meet your needs, and we will also help you to get a leg-up on next year by saving while you repay.

A typical loan of £500.00 from the credit union over 12 months at our standard rate of 42.6% APR would have repayments of just £11.50 per week (or £51 per month). Total interest charged around £97.02 (£101.09 if repaid monthly).

Please note the figures above are a representative example and may vary. All loans are subject to status and approval.

Stop Loan Sharks investigates and prosecutes illegal money lenders and provides support for borrowers in the UK.

Families who are struggling to make ends meet could be at risk of falling prey to predatory lenders who offer quick cash loans at astronomical rates.

These loans can lead people into long-term financial hardship, with exorbitant interest rates as high as 100,000% and threats that leave borrowers trapped in a cycle of debt for years.

A recent study by the Centre for Social Justice (CSJ) revealed that more than one million people could be in debt to loan sharks in England.

Nearly half of people who borrow from illegal lenders use the cash for everyday expenses and household bills, including the purchase of school uniforms and prams.

Warning signs to indicate that you could be dealing with a loan shark include giving no paperwork upon the agreement of a loan, refusing to give detailed information about a loan, intimidation and threats, taking items such as a bank card or passport until the debt is paid, and taking things from you if you do not pay on time.

View the full news release here

if you or anyone else you know is in trouble because of a loan shark, be sure to contact Stop Loan Sharks at www.stoploansharks.co.uk.

Join our community and benefit from a

more financially stable future