Goal Savings Account

Most of us have that something special in mind we want to save for. Whether that’s a dream holiday, home improvements or even a little extra money for a great Christmas or big family celebration. But, when it comes down to it, how many of us actually stick to a savings plan?

A study has shown that people who save with a set goal do it faster than those without one. So, with our Goal savings account, you’ll find reaching your savings target a whole lot easier.

This online and mobile only account lets you set your own personal goals, manage your savings directly and track progress towards your target. If you have more than one goal in mind, you’ve the option to set up 10 in total.

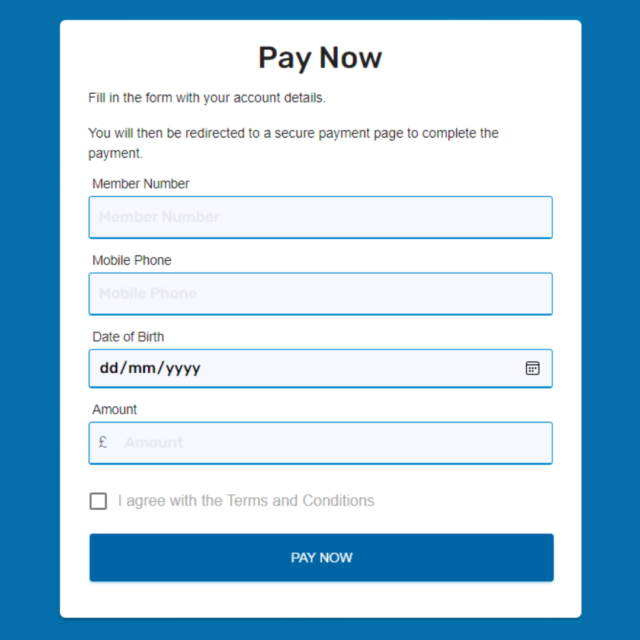

If you already have an NLCU account, just log in and complete the Goal Savings form. If you don’t have an account, create a new one today to start saving.

Here’s how it works

Step 1: Choose your first goal

Your new goal savings account will appear alongside your other account balances. Press the + button to set your first savings goal.

If you’re unsure how to start, check out the Money Helper guide on How to set a savings goal.

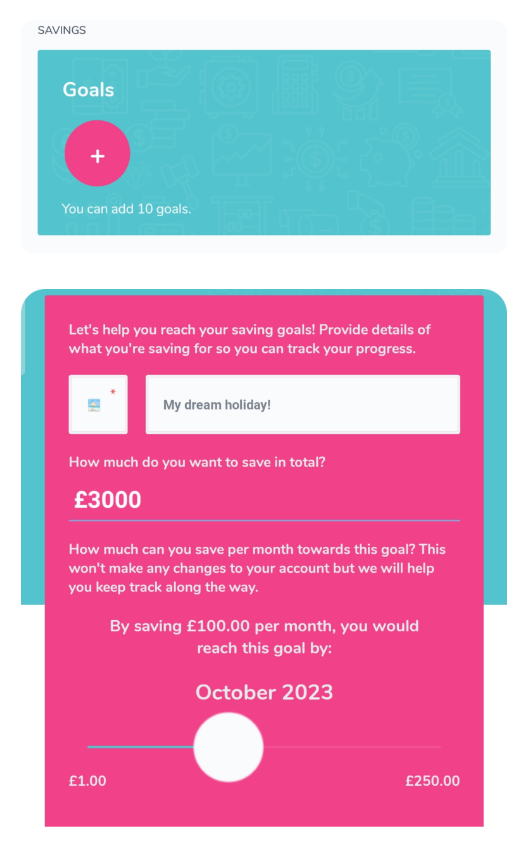

Step 2: Personalise your goal

Our online and mobile app gives the option to give your goal a name and an image.

Start by choosing an emoji that will represent your goal on your home screen.

Then give your new goal a name. Calling it something special will encourage you to meet your target faster. For example, instead of naming it ‘Holiday’, perhaps use ‘Two weeks in Mexico’.

Step 3: Set your Goal Value

Go big or start small with the amount you’ll be aiming to save.

If a large goal seems daunting to you, it may help to set multiple smaller ‘milestone’ goals instead. For instance, one larger holiday goal could be split into things like flights, accommodation and spending money.

Step 4: How soon you want to reach your goal

Using the slider, you can get a good idea of how soon you’ll reach your goal with what you can afford to save.

And that’s it

Your new goal will show on your homepage and the pink circle around it will fill up to show you how close you are to reaching your savings target.

Next steps

Start saving

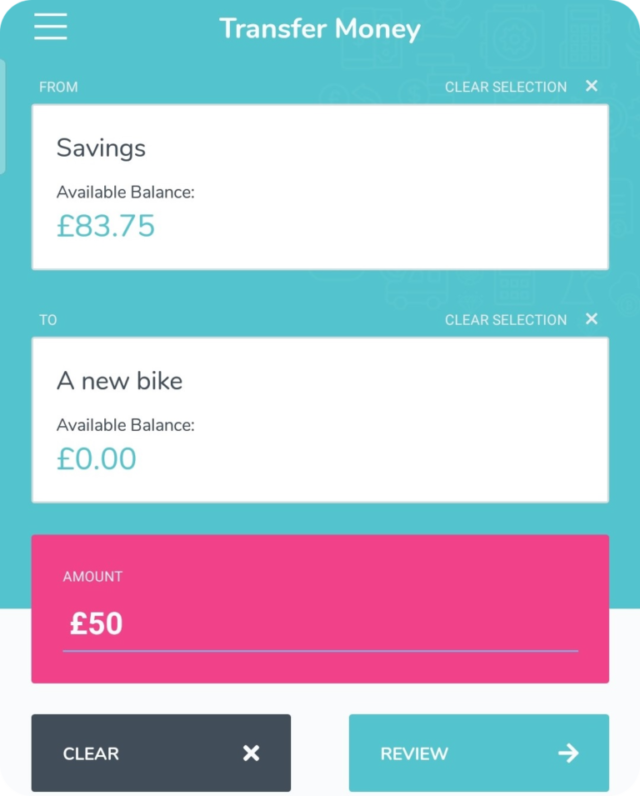

To pay into your goal savings account, you have to move funds over from your other NLCU savings accounts. This gives you full control of your savings and lets you choose when to add an amount.

Select ‘Transfer Money’ from one of your accounts or, in the menu, request a transfer into your new goal savings account.

Transfers like this will usually be made within 10 minutes, but they can take up to one working day to process.

Keep an eye on your progress

The closer you get to reaching your goal, the more the pink circle will fill up around it. So you can easily see the progress you’ve made so far.

Your goals will be shown every time you access your NLCU account to remind you of where you are and to keep up the good work.

Ready to withdraw?

Whether you’ve met your goal, or you just need to access some of the funds in advance, you can request a withdrawal from your goal savings account at any time, subject to our usual processing times.

Don’t push yourself too early

While it’s important to have savings and to set a goal to work toward, this shouldn’t get in the way of the other things in your life you have to pay for. It’s best to get an idea of your budget before setting your goal, so as not to be unrealistic about your savings.

Cutting back on non-essentials is a good way to save, but don’t let this affect your quality of life too much. If you’ve done a good job saving so far, why not treat yourself?

All of us are only able to save so much at a time. If you’re struggling to stick to your savings plan, don’t be afraid to review your approach or, if needed, withdraw some of the funds.

Added interest

With our goal savings account, you may receive an annual dividend. But this depends on how well we’re doing as a company and the approval of members at our AGM.

Savings

How do I pay into my account?

You can make deposits into your savings account with us either by cheque, by bank transfer or by payroll deduction. If you have lost your NLCU bank account details then just get in touch and we’ll confirm them for you.

The amount you save we leave up to you! There are no transactional fees with saving. We have a range of savings accounts and you can request your deposits be split for different purposes like Christmas or Holidays. The maximum balance we can hold in our accounts for a single person is £10000.

Do I get a return on my savings?

Usually yes! As a financial cooperative we share our profits with our shareholders – and all our customers are our shareholders.

Once we have paid for running costs and paid into our legally required reserves we share the rest amongst members based on the amount in their savings. The dividend that we pay to our members is voted on at our yearly AGM – see our downloads page for more info from our last AGM.

How do I withdraw money from my account?

You can withdraw funds:

- Online using our online banking service or our mobile app

- Over the phone on 0330 004 0842 – lines open Monday to Friday 10am-3pm

How soon will my requested withdrawal reach my bank account?

Requested withdrawals are processed between 9am and 3pm every weekday. Withdrawals made after 3pm, on weekends or bank holidays will be sent the following workday morning.

If requested online, this show as “Pending” until we’ve set up your withdrawal.

Are my savings safe?

Notts and Lincs Credit Union is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

All savings held with Notts and Lincs Credit Union are protected under the Financial Services Compensation Scheme which protects savings up to the value of £85,000.