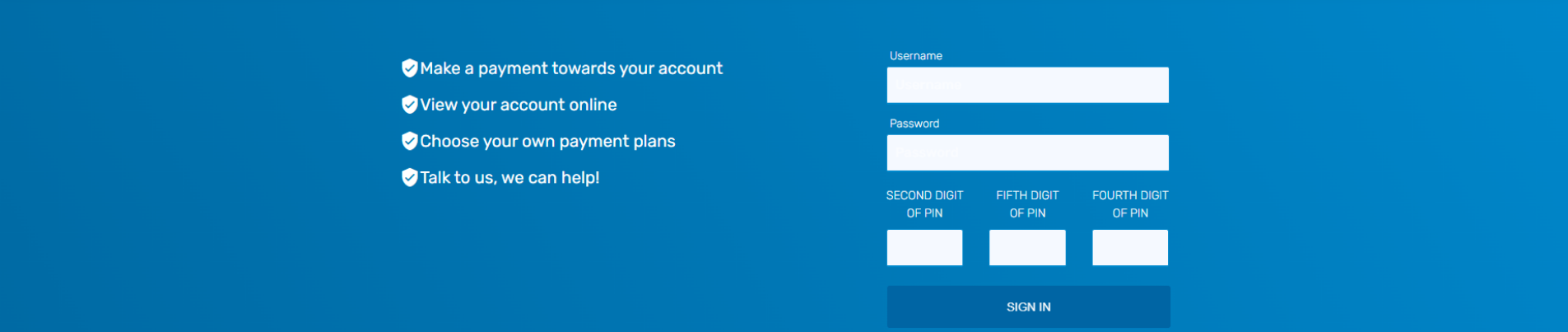

Self Service Portal

Welcome to our Self-Service Portal, where convenience meets control. Are you looking for a seamless solution to update your loan payment options?

Our portal empowers you to manage your loan effortlessly, 24/7 365 days a year from anywhere you please, without the need to call our branch. From flexible payment plans to setting up direct debits, take charge of your finances with ease. Explore the power of self-service and experience banking on your terms.

Discover the capabilities of our brand new self-service portal, saving you time with transactions:

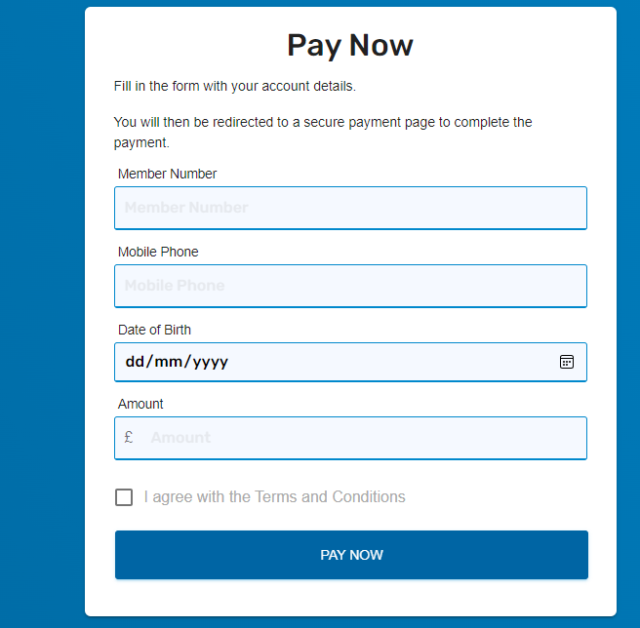

- Resolve missed payments fast with Quick Pay functionality.

- Take control of your financial goals by paying off your loan balance ahead of schedule.

- Easily make payments towards your account with just a few clicks.

- Gain instant access to your account details anytime, anywhere with our online viewing feature.

- Customize your payment plans to suit your unique needs and preferences.

Experience the freedom of managing your loan effortlessly with our user-friendly self-service portal.

I cannot repay my loan using the portal, what can I do?

- Get in touch as soon as you know that you might have difficulty making a payment.

- Use this portal to complete an income and expenditure form which will help us to assess how much you can realistically afford to repay.

- Create a payment plan that suit both you and the Credit Union.

- Keep to your new payment plan and let us know as soon as you can if this is becoming difficult.

- Choose a method of contacting us that you are most comfortable with, such as through this portal, email or telephone.

- Keep us updated with any new contact details.

- Respond quickly to any messages we may send.

- Seek the help of an advice agency if you have lots of debts or if you don’t think you can afford to pay anything (See debt management resources).

What will you (Notts and Lincs Credit Union) do?

- Discuss your circumstances or worries in a sympathetic and sensitive manner.

- Establish the extent of your difficulties and work with you to assess your options for repayment.

- Agree on a reduced payment plan and agree to a review date that you are happy with.

- Refer you to an advice agency that will help you rather than make things worse. (See debt management resources)

Will I be charged for being in arrears?

No, we don’t charge for missed repayment. However, if you do miss payments your interest will accrue, meaning your loan will cost you more overall.

Can I pay my loan back early?

Members can clear the balance of a loan at any time, and we do not charge any early settlement fees for this.

Can I borrow again if I fall into arrears?

You will need to bring your account up to date to be eligible before applying for further borrowing. Your payment history with Notts & Lincs Credit Union is considered when we make our loan decisions.

Debt management resources

If you do fall into financial difficulties, we would always encourage you to contact all your creditors first to explain your current circumstances, they will likely be able to support you through this difficult time. We also strongly suggest you not to be led into a debt management plan without the terms, repercussions and costs explained fully, as many companies who offer these plans are only out to make money from your predicament. There are reputable agencies which help people in financial difficulties. These include:

Citizens Advice Bureau (CAB)

Money Advice Trust

National Debt Line

Step Change Debt Charity

Illegal Money Lending Team

UK Government website

You can also use our Debt Advice Services page for more information.

Are my debit card details secure using this portal?

PCI Compliant

We have undergone stringent testing to ensure our system for the accepting and processing of payments is secure. Upon completion we were deemed PCI compliant (The Payment Card Industry Data Security Standard is a proprietary information security standard for organizations that handle cardholder information for the major debit, credit, prepaid, e-purse, ATM, and POS cards).

SSL

All our data and transactions go through 2048-bit SSL encryption which means that all transactions and data are secure and cannot be captured by network sniffer devices at any time

Global Payments (formerly known as Realex)

All payments are processed through Global Payments. We do not hold any card details on our systems, these are all managed via Global Payments, who have set the standard in the market place for secure processing