Understanding Your Credit Report

A credit report is a detailed record of an individual’s credit history and financial behaviour.

It is maintained by credit reference agencies, such as Experian, Equifax, and TransUnion.

A credit report is an essential tool used by lenders and other financial institutions to assess a person’s creditworthiness when applying for credit products, such as loans, credit cards, mortgages, and overdrafts.

A credit report contains various information, including

Personal Information

Your name, address, date of birth, and electoral roll information.

Credit Accounts

Details of credit accounts you have opened, such as credit cards, loans, mortgages, Buy No Pay Later, phone and utility bills. It includes the name of the creditor, account type, credit limit or loan amount, current balance, and payment history.

Public Records

Information on any financial-related public records, such as County Court Judgments (CCJs), bankruptcies, or Individual Voluntary Arrangements (IVAs)

Credit Searches

A record of any organisations that have accessed your credit file when you applied for credit.

Financial Associations

Information about anyone you have a financial connection with, such as a joint account or mortgage.

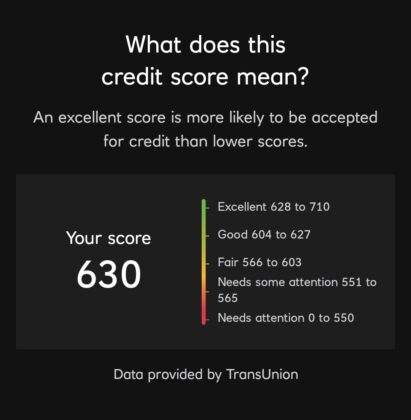

What does my credit score mean?

We use TransUnion as our credit reference agency.

Your credit score is a numerical representation of your creditworthiness based on the information in your credit file. Each credit reference agency calculates credit scores slightly differently, but they generally use a scale or band to indicate how creditworthy you are.

A higher credit score indicates a lower credit risk, making it more likely for lenders to approve your credit applications and offer you better terms, such as lower interest rates. Conversely, a lower credit score may lead to difficulties in obtaining credit or result in higher interest rates on loans and credit cards.

It’s important to note that different lenders may have varying criteria for evaluating credit applications, and they may consider additional factors beyond the credit score when making lending decisions.

To maintain a healthy credit score, it’s crucial to demonstrate responsible financial behaviour, such as paying bills and loans on time, not maxing out credit cards, and avoiding excessive credit applications. Regularly reviewing your credit file for accuracy and addressing any errors promptly can also help maintain a positive credit score.

Remember, your credit score is not fixed and can change over time based on your financial actions and behaviours. By being proactive and responsible with your finances, you can work towards improving and maintaining a favourable credit score.