Our Savings Accounts

We’ve a range of savings accounts, whether you’re looking to save for something in particular, such as a holiday or home improvements, or you just want to put away some money for a rainy day.

Regular Savings Account

- Start saving with as little as £1

- No limit on deposits and withdrawals

- Requesting a withdrawal is quick and easy

- 24-hour access to your account online

or with our mobile app

Christmas Savings Account

- Save for one of the most costly times of the year

- Withdrawals only allowed between October and January

- Use our mobile app to keep track of your Xmas savings

- You could receive a dividend on your savings

Holiday Savings Account

- Save for your next holiday adventure

- A second savings pot alongside your regular savings account

- You could receive a dividend in May

- A handy mobile app to keep track of your savings

Junior Savings Account

- A great way to encourage an early savings habit

- A separate account for members’ children or grandchildren

- For children from birth up to 17 years of age

- Accounts handed over at age 18

Goal Savings Account

- Save faster by setting your own savings goals

- Manage your savings directly and track your progress

- Only available to online and mobile app users

- Request withdrawals 24 hours a day

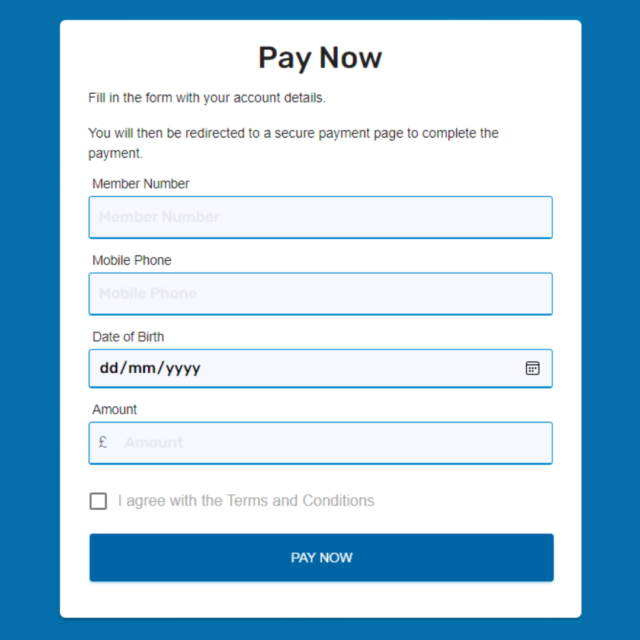

Manage your money

online, at any time.

Request withdrawals and manage your savings account using our simple and fully

secure online members platform.

Track your savings

with our mobile app

With our handy mobile app it’s easy to keep track of your savings and manage your account at any time.

Download our mobile app

You can save with us if you:

- Live or work in Nottinghamshire or Lincolnshire (excluding Humberside)

- Work for one of our Payroll Partners

- Live in NCHA accommodation

- Are 18 years of age or over

Why you should save with us

- We’re a local, not-for-profit organisation

- We are owned and run by our members

- We help you save for a financial future that’s more secure

- We focus on what really matters – providing the best service

- We operate in a fair, responsible and ethical way

Savings

How do I pay into my account?

You can make deposits into your savings account with us either by cheque, by bank transfer or by payroll deduction. If you have lost your NLCU bank account details then just get in touch and we’ll confirm them for you.

The amount you save we leave up to you! There are no transactional fees with saving. We have a range of savings accounts and you can request your deposits be split for different purposes like Christmas or Holidays. The maximum balance we can hold in our accounts for a single person is £10000.

Do I get a return on my savings?

Usually yes! As a financial cooperative we share our profits with our shareholders – and all our customers are our shareholders.

Once we have paid for running costs and paid into our legally required reserves we share the rest amongst members based on the amount in their savings. The dividend that we pay to our members is voted on at our yearly AGM – see our downloads page for more info from our last AGM.

How do I withdraw money from my account?

You can withdraw funds:

- Online using our online banking service or our mobile app

- Over the phone on 0330 004 0842 – lines open Monday to Friday 10am-3pm

How soon will my requested withdrawal reach my bank account?

Requested withdrawals are processed between 9am and 3pm every weekday. Withdrawals made after 3pm, on weekends or bank holidays will be sent the following workday morning.

If requested online, this show as “Pending” until we’ve set up your withdrawal.

Are my savings safe?

Notts and Lincs Credit Union is authorised by the Prudential Regulation Authority and regulated by the Financial Conduct Authority and the Prudential Regulation Authority.

All savings held with Notts and Lincs Credit Union are protected under the Financial Services Compensation Scheme which protects savings up to the value of £85,000.