Consolidate in November, Pay in January

We are offering our Payroll members the opportunity to consolidate their debts to us and defer their repayments until January 2023.

This means you could consolidate your debts to us and have no repayments to make until the new year. Giving you more flexibility over the festive period.

You simply need to sign into your account to apply, and choose the “Debt Consolidation Loan” form to submit your application. We will automatically check for eligibility to this offer when your application comes through to us.

Use our Consolidation Loan Calculator to see how much you could save:

Q&A

What is debt a consolidation loan?

A debt consolidation loan is a type of loan that’s used to combine all your existing debts into one loan. All you’ll need to do is use our Consolidation Loan Calculator to calculate the amount you need to apply for and if approved, we will directly pay off the debts you owe. You’ll then repay the loan over the agreed term.

Not only could a debt consolidation loan make your debt easier to manage, but it can also reduce the amount of interest you pay and your total monthly payments, by having all your debt in one place at a lower interest rate.

Is debt consolidation a good idea?

Whether a debt consolidation loan is a good option for you will depend on your financial situation.

Pros:

- Reduced monthly repayments

- Lower overall interest rate

- Easier to manage

- Boost your credit score

Cons:

- Missed repayments have consequences on your credit score and your ability to borrow in the future

- There may be settlement fees on your debt from your existing creditors

- There may be 0% options available

What debts can I consolidate?

You can consolidate:

- Personal & Payday Loans

- Credit & Store Cards

- Mail Order Catalogues

- Overdrafts

- Buy Now Pay Later (that are not interest-free)

How will you pay my creditors?

You will need to supply us with written confirmation from your creditors of the following:

- Balance or Settlement Figure (for loans)

- Reference/Account Number

- The creditor’s Sort Code and Account Number

These will usually be on your PDF statements or within your online portals.

When will I make my 1st payment?

Your 1st payment will be from your January salary.

Will I still be charged interest?

Yes, interest on your loan will accrue from the date your loan is granted.

Do I have to start my repayments in January?

No, if you wish them to start from your 1st available payday in November or December, just let us know.

Do I have to save alongside my loan?

Yes, a savings amount will be set up alongside your loan payment. Usually around 10% of your loan payment.

What's the minimum/maximum I can borrow?

We offer loans from £1,000 – £15,000

Related Articles

News

Special General Meeting – 25th June 2024

Join Us for Our Special General Meeting! Notts and Lincs Credit Union Special General Meeting (SGM) to be held…

News

We are finalists!

We are excited to announce that our credit union is a finalist for the Consumer Credit Awards this year, and…

Financial Wellbeing

5 Proven Strategies to Elevate Your Credit Score

Building a strong credit score is crucial for securing beneficial loan terms, renting/purchasing a property, and even landing certain jobs.…

News

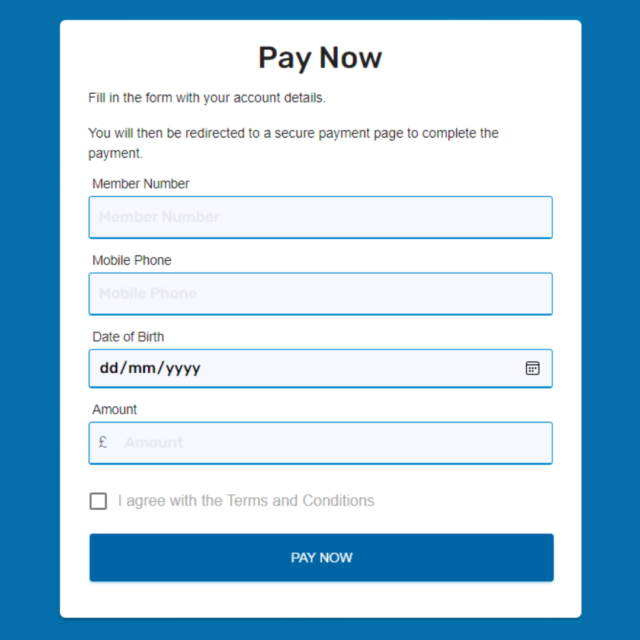

Introducing Our New Self-Service Payments Portal

More Information About Our Portal Welcome our brand new Self-Service Portal, where convenience meets control. We understand that managing…

News

Vote for your Credit Union in the Consumer Credit Awards for a chance to win £1,000!

This year, our credit union has once again been nominated for the Consumer Credit Awards, and we're reaching out to…

News

Consumer Credit Awards Results

In the realm of financial institutions, it's not just about profit margins and balance sheets; it's about the positive…

News

Branch Closures

We've recently announced that we're closing our Lincoln and Mansfield branches. There are many other ways to continue to access…

News

Online Services

We have made the difficult decision to close our Lincoln and Mansfield branches. Recognising that the move to mobile and…

News

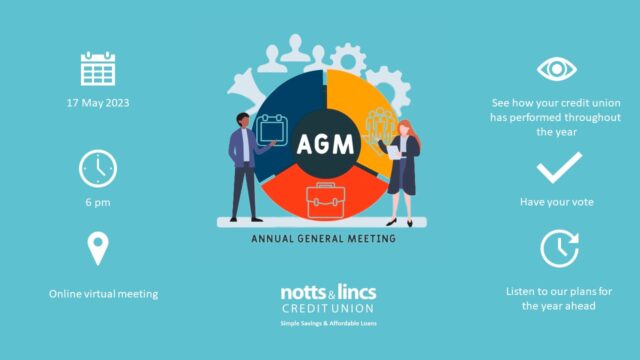

AGM 2023

Download our annual report for 2022

News

Boots Payroll Deduction Scheme Update

From 1st April 2023, Boots UK LTD will no longer offer the Payroll Deduction Scheme with Notts & Lincs…

News

10 Tips to Save Up – Ready, Set, Save!

Do you make New Year’s Resolutions in January and forget all about them in March? Or do you promise you’ll…

News

New Debt Consolidation Loan Process

For those making repayments of different amounts, at different times of the month, or all at different rates – a…

News

Saving Towards your New Year’s Resolutions

Our Goal Savings account is available to all members of the credit union, whether you join today or you’ve been…

Join our community and benefit from a

more financially stable future